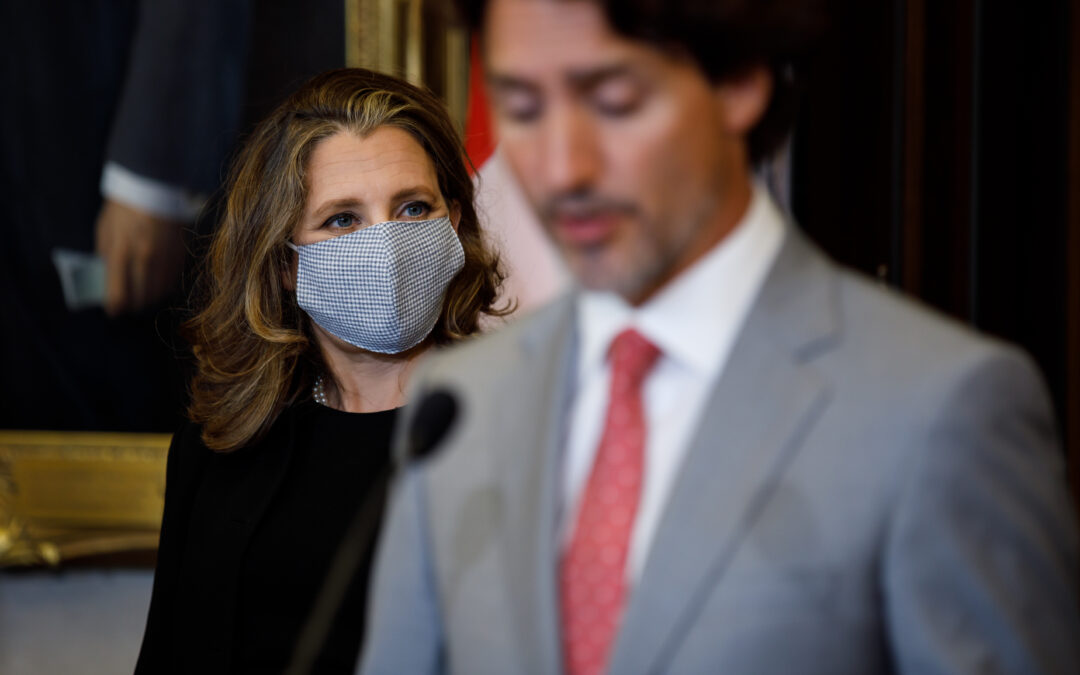

Freeland’s massive pandemic budget charts path towards recovery

This afternoon, Finance Minister Chrystia Freeland presented the long-awaited 2021 federal budget – the first in over two years. Easily the largest budget in Canadian history with $101.4 billion in new spending over three years, the 724-page document lays out the government’s sweeping plans to get through the third wave of the pandemic, address inequities exacerbated over the past year, and position the country for economic recovery. With an election looming after the pandemic is over, this budget will surely serve as the basis for the Liberals’ next election campaign.

Fiscal Framework

The budget reports a $354 billion deficit in 2020-21, down from the $382 billion forecast in the Fall Economic Statement, as Canada’s GDP had started to rebound by almost 10 per cent on an annualized basis in Q4 of 2020. While it remains to be seen what the economic impact of the current third wave will be, the budget forecasts a $154 billion deficit in 2021-22.

The government forecasts a declining debt-to-GDP ratio and a declining deficit, with the debt-to-GDP ratio holding relatively steady from today’s 51.2% to 49.2% per cent by 2025-2026. While this is by far the lowest in the G7, it signals that 50% debt-to-GDP is the “new normal” for the Liberals. The government also forecasts the deficit falling to $30.7 billion by 2025-26. Despite record levels of federal debt, Canada’s interest rate payments are at their lowest in over a century.

Canada is still 460,000 jobs short of where we were before the pandemic – halfway towards its goal of creating 1 million jobs by the end of 2021, announced in the Fall Economic Statement. Instead of creating a new “fiscal anchor” to guide the budget, the government is now tracking its fiscal progress against several job-related economic indicators to assess and gauge the impact of fiscal policy support, including employment rate, total hours worked, and unemployment rate.

Child Care

The headline investment in the plan is a $30 billion commitment to build a new national child care system over 5 years and $8 billion annually thereafter, for a 50/50 cost share with provincial governments. This funding will also initiate progress towards a $10/day price for all regulated child care spaces, annual growth of quality child care spaces, and improvement and expansion of before- and after-school programs.

After the lack of affordable child care options contributed significantly to the uneven impact of the pandemic on women, the new program is geared towards increasing the participation of women in the workforce, building off the successful Quebec model at a cost of $10 per day, on average, for regulated child care. The government will start by cutting daycare fees outside of Quebec in half next year – leaving more money in parents’ pockets.

Pandemic and Social Supports

As events across the country have demonstrated over the past week, the pandemic is far from over. Accordingly, Budget 2021 proposes to extend the Canada Emergency Wage Subsidy, Rent Subsidy and Lockdown Support until September 25, 2021. It also proposes to gradually decrease the subsidy rate, beginning July 4, 2021, in order to ensure an orderly phase-out of the program as vaccinations are completed, and the economy reopens.

The budget provides 12 additional weeks of Canada Recovery Benefit to a maximum of 50 weeks. The first four of these additional 12 weeks will be paid at $500 per week. As the economy reopens over the coming months, the government intends that the remaining 8 weeks of this extension will be paid at a lower amount of $300 per week claimed.

The need for paid sick leave has been in the spotlight throughout the pandemic. The budget provides funding of $3 billion over five years, starting in 2021-22, and $966.9 million per year ongoing to enhance sickness benefits from 15 to 26 weeks. This extension, which would take effect in summer 2022, would provide approximately 169,000 Canadians every year with additional time and flexibility to recover and return to work.

The government is also fulfilling its promise to boost Old Age Security for Canadians aged 75 and older, which will provide up to $766 more for eligible seniors in the first year, increasing with indexation.

Health

The budget is full of measures to bolster Canada’s health care system without permanently increasing health transfers to the provinces. New measures include:

-

-

-

- $3 billion over five years, starting in 2022-23, to Health Canada to support provinces and territories in ensuring standards for long-term care are applied, and permanent changes are made.

-

-

-

-

-

- $2.2 billion to Canada’s bio-manufacturing and life-sciences sector over seven years, including support for the Canada Foundation of Innovation and research granting councils.

-

-

-

-

-

- $1 billion on a cash basis over seven years, starting in 2021-22, of support through the Strategic Innovation Fund would be targeted toward promising domestic life sciences and bio-manufacturing firms.

-

-

-

-

-

- $41.3 million over six years, and $7.7 million ongoing, starting in 2021-22, for Statistics Canada to improve data infrastructure and data collection on supportive care, primary care, and pharmaceuticals.

-

-

-

-

-

- $45 million over two years, starting in 2021-22, to Health Canada, the Public Health Agency of Canada, and the Canadian Institutes of Health Research to help develop national mental health service standards, in collaboration with provinces and territories, health organizations, and key stakeholders.

-

-

-

-

-

- $116 million over two years, starting in 2021-22, building on $66 million invested in the 2020 Fall Economic Statement for the Substance Use and Addictions Program to support a range of innovative approaches to harm reduction, treatment, and prevention at the community level.

-

-

Notably missing from the budget was any committed funding for pharmacare and only a brief commitment to continue engaging provincial governments on the subject, indicating that the Liberals may be abandoning the project for now. The government recommitted to investing $500 million annually towards rare disease drugs.

Business Investment and Training

To kickstart the economic recovery, the budget introduces a new Canada Recovery Hiring Program, which will reduce the incremental cost of hiring new workers or increasing their hours as business ramps back up after the pandemic. Starting in June, the program will cover 50% of a new employee’s salary or increased hours ($1,129 per worker per week is the maximum eligible salary), tapering off to 20% by November, for a total program cost of $595 million.

The budget also invests $2.2 billion over seven years through the Strategic Innovation Fund, and $511.4 million ongoing, to support innovative projects across the economy—including in the life sciences, automotive, aerospace, and agriculture sectors.

The government will allow the immediate expensing of up to $1.5 million of eligible investments by Canadian-controlled private corporations in each of the next three years. It is estimated that these larger deductions will represent $2.2 billion in additional support that will help drive growth and create jobs, supporting 325,000 businesses in making critical investments to grow their output.

The budget creates nearly 500,000 new training and work experience opportunities for Canadians over ten different programs. This includes $960 million over three years, beginning in 2021-22, for a new Sectoral Workforce Solutions Program. Working primarily with sector associations and employers, funding would help design and deliver training that is relevant to the needs of businesses, especially small and medium-sized businesses, and to their employees. This funding would also help businesses recruit and retain a diverse and inclusive workforce.

Small Business

The main small business program in the budget is a new Canada Digital Adoption Program that will provide $4 billion over four years to benefit 160,000 SMEs with tax incentives to help small businesses adapt to e-commerce and expand, divided into two streams:

-

-

-

- To help main street businesses expand their customer bases online, they can access support to digitize and take advantage of e-commerce opportunities. This initiative will be supported by 28,000 “digital trainers.”

- Some businesses will require more comprehensive support to adopt new technology. A second stream will be offered for “off-main street” businesses, such as small manufacturing and food processing operations. Support for these businesses will emphasize advisory expertise for technology planning and financing options needed to put these technologies to use.

-

-

The government also committed to launching negotiations with credit-card companies in an effort to reduce the swipe fees that merchants must pay.

Housing & Retrofits

Budget 2021 proposes to provide $4.4 billion to the Canada Mortgage and Housing Corporation (CMHC) to help homeowners complete deep home retrofits through interest-free loans worth up to $40,000. Loans would be available to homeowners and landlords who undertake retrofits identified through an authorized EnerGuide energy assessment. In combination with available grants announced in the Fall Economic Statement, this would help eligible participants make deeper, more costly retrofits that have the biggest impact in reducing a home’s environmental footprint and energy bills. This program will also include a dedicated stream of funding to support low-income homeowners and rental properties serving low-income renters, including cooperatives and not-for-profit-owned housing.

Budget 2021 also announces the government’s intention to implement a national, annual 1% tax on the value of non-resident, non-Canadian owned residential real estate that is considered to be vacant or underused, effective January 1, 2022. The tax will require all owners, other than Canadian citizens or permanent residents of Canada, to file a declaration as to the current use of the property, with significant penalties for failure to file.

An additional $1.5 billion was announced for the Rapid Housing Initiative in 2021-22 to address the urgent housing needs of vulnerable Canadians by providing them with adequate, affordable housing in short order. At least 25 per cent of this funding would go towards women-focused housing projects, and units would be constructed within 12 months of when funding is provided to program applicants. Overall, this new funding will add a minimum of 4,500 new affordable units to Canada’s housing supply, building on the 4,700 units already funded in the 2020 Fall Economic Statement through its $1 billion investment.

Climate Change & Energy

In the wake of last week’s Conservative climate plan, the new climate initiatives in the budget are projected to go beyond the Paris target of a 30% reduction in GHG emissions below 2005 levels by 2030, achieving a 36% reduction when combined with previous initiatives.

To back up this tough new target, the budget invests an additional $5 billion over seven years through the Strategic Innovation Fund’s Net Zero Accelerator to help decarbonize heavy industry, support clean technologies and help meaningfully accelerate domestic greenhouse gas emissions reduction. This is in addition to the $3 billion announced in the December climate plan update.

The government is also planning an investment tax credit for capital invested in Carbon Capture and Storage projects with the goal of reducing emissions by at least 15 megatonnes of CO2 annually – including support for direct air capture and hydrogen production. After a planned consultation and new legislation, this measure will come into effect in 2022. In addition, the budget invests $319 million over seven years for carbon capture R&D.

Effective immediately, the government will expand capital cost allowance to clean energy equipment, including:

-

-

-

- Pumped hydroelectric storage equipment;

- Hydroelectricity generation equipment and tidal energy;

- Active solar heating systems, ground source heat pump systems

- Equipment used to produce solid and liquid fuels (e.g., wood pellets and renewable diesel) from specified waste material or carbon dioxide;

- Hydrogen electrolyzers; and

- Equipment used to dispense hydrogen for use in hydrogen-powered automotive equipment and vehicles.

-

-

On the other hand, effective in 2024, the government will eliminate capital cost allowance deduction for natural gas to electricity cogeneration systems and natural gas generating equipment, for which more than one-quarter of the total fuel energy input is from fossil fuels.

The budget will reduce corporate income tax rates for qualifying zero-emission technology manufacturers, including: solar panels; wind turbines; hydroelectric and tidal power equipment; geothermal energy equipment; ground source heat pumps; electrical energy storage for renewable energy or grid-scale storage; zero-emission vehicles (i.e., plug-in hybrid vehicles with a battery capacity of at least seven kilowatt-hours, electric vehicles and hydrogen-powered vehicles); batteries and fuel cells for zero-emission vehicles; electric vehicle charging systems and hydrogen refuelling stations for vehicles; hydrogen electrolyzers; and the production of solid, liquid or gaseous fuel (e.g., wood pellets, renewable diesel and biogas) from either carbon dioxide or specified waste materials.

New Tax Changes

Canada is working with the OECD to “find multilateral solutions to the dangerous race to the bottom in corporate taxation,” including a deal to tax large digital services companies, with hopes that such a deal can be reached this summer.

This includes sales tax for foreign-based digital services (i.e. the controversial “Netflix tax”) and e-commerce warehouses like Amazon starting in July, and a digital services tax for Web giants like Google, Facebook, Uber and Airbnb from 2022.

Canada will aim to limit the amount of excessive interest expenses that can be deducted from profit, although small businesses will be exempt. It is estimated that this measure will increase federal revenues by $5.3 billion over five years, starting in 2021-22.

The government also announced a new luxury tax on yachts (worth over $250,000) and expensive automobiles and private aircraft (worth over $100,000).

Women

Today’s budget had a significant focus on women-specific support, addressing some of the disparities highlighted by the pandemic. Significantly, the government has strongly emphasized investments and initiatives aimed at tackling gender-based violence.

To highlight a few examples, the Department for Women and Gender Equality will oversee $200 million in support for gender-based violence organizations, as well as provide additional funding to establish a dedicated secretariat for development and implementation of the National Action Plan to End Gender-Based Violence, develop a national femicide database, and support a new national program for independent legal advice and independent legal representation for victims of sexual assault.

There is also an investment of $172 million over five years to Statistics Canada to implement a Disaggregated Data Action Plan that will fill data and knowledge gaps. This funding will support more representative data collection, enhance statistics on diverse populations, and support the government’s efforts to address systemic racism, gender gaps—including the power gaps between men and women—and bring fairness and inclusion considerations into decision making.

Indigenous Services and Reconciliation

Budget 2021 contains significant investments in Indigenous health, social services, education, infrastructure and governance – totalling $18 billion in new spending over the next five years.

Crown Indigenous Relations and Northern Affairs Canada (CIRNAC) is receiving a significant injection of funding to upgrade their Rights and Recognition capacity – a process that has been overwhelmed by hundreds of rights claims from Indigenous communities across Canada.

There are also commitments to overhaul the Addition-to-Reserve (ATR) process, a long-overdue reform to a frustrating bureaucratic process.

While there are dozens of new spending priorities for indigenous communities laid out in Budget 2021, some highlights include:

-

-

-

- $515 million over five years, starting in 2021-22, and $112 million ongoing, to support before and after-school care for First Nations children on reserve.

- $1.4 billion over five years, starting in 2021-22, and $385 million ongoing, to ensure that more Indigenous families have access to high-quality programming. Guided by Indigenous priorities and distinctions-based envelopes, this investment will build Indigenous governance capacity and allow providers to offer more flexible and full-time hours of care, build, train and retain a skilled workforce, and create up to 3,300 new spaces. This will include new investments in Aboriginal Head Start in Urban and Northern Communities.

- $23.5 million to the Public Prosecution Service of Canada to support victims of violence by increasing prosecutorial capacity in the territories.

- $774.6 million over five years, beginning in 2021-22, to ensure continued high-quality care through the Non-Insured Health Benefits Program, which supports First Nations and Inuit people with medically necessary services not otherwise covered, such as mental health services, medical travel, medications, and more.

- $107.1 million over three years, beginning in 2021-22, to continue efforts to transform how health care services are designed and delivered by First Nations communities, building on the government’s commitment to improving access to high-quality and culturally relevant health care for Indigenous peoples.

- $1.7 billion over five years, starting in 2021-22, with $388.9 million ongoing, to cover the operations and maintenance costs of community infrastructure in First Nations communities on reserve.

-

-

Political Considerations

The budget debate will dominate the House of Commons over the next several weeks, with its passage amounting to a confidence vote which threatens to topple the Liberal minority government. While opposition leaders have all previously stated they do not wish to see the country thrown into an election, while much of Canada is in the third wave of the pandemic, they will be in a tight spot when voting on certain measures.

The NDP has already indicated that they do not intend to force an election during the pandemic, laying track to support the budget, which is full of progressive program spending. However, Jagmeet Singh criticized the Liberals for lack of measures to tax the ultra-rich and failing to address pharmacare and suggested the Liberals would not follow through on promises on things like child care. The other party holding the balance of power, the Bloc Quebecois, acknowledged there are some “good things” in the budget on climate policy. He criticized them for failing to boost provincial health transfers and for not going far enough with support for seniors. While Yves-François Blanchet told reporters the BQ is “ready” to vote against the budget, he left the door open to supporting it.

The Conservatives are focussing on the size of the deficit and the long-term uncertainty associated with large debt, and the risk of rising inflationary pressure. Already we have seen speeches in the House by MPs, including MP Pierre Poilievre, that draw direct connections between Pierre Trudeau’s budgets from the early 1980s and the 2021 budget. They are expected to advance amendments to the budget in the coming days.

On specific policies, the ideological differences between the Conservatives and Liberals will be on display. Of note, the $10 per day child care plan will be criticized for its lack of flexibility and dubbed the “Ottawa-knows-best” approach to childcare. Expect Erin O’Toole to provide contrast with a policy emphasizing direct child care payments to parents.

For this pre-election budget, Liberals have gone all in to win over the votes of women, who tend to decide elections in Canada as traditional swing voters. Women voters may also be particularly attuned to this upcoming election, having been most heavily impacted by the pandemic. By making a direct appeal to women, suburbanites and climate-conscious voters, the Liberals are portraying themselves as the true progressive choice – a gambit that will be necessary to keep NDP- and Green-sympathetic voters onside at a time when the Conservatives are low in the polls.

Counsel’s federal team will continue to review the budget over the coming days. Please do not hesitate to contact us if you need any further information.