When governments reveal their annual budgets, the presentation is accompanied by much pomp and circumstance and the speech tends to dominate the news cycle for at least the day, if not the week. This Ontario budget won’t do that. It is short on both “new” news or fresh policy initiatives. It doesn’t contain the normal laundry list of key government priorities and legislation that will set the tone for the next three or four months of political debate.

Instead, this document and this speech are meant to provide Ontarians assurance that the Ford government – and this Finance Minister, in particular – is taking a prudent, careful view of Ontario’s fiscal plan and giving itself lots of fiscal room in case the Ontario, or world, economy hits rocky shoals again.

Instead of delivering days of front page news, the Finance Minister sought to weave a narrative of growth and prudence by re-announcing several initiatives that have been introduced over the past number of months. That narrative was anchored in the word “prudence,” which was found throughout the document.

So, in short, “no news is good news,” at least if you’re Peter Bethlenfalvy.

Key Economic Numbers – A Story of Revenue Growth and Prudence

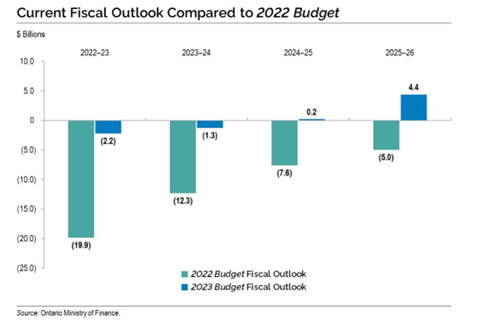

For the Finance Minister, the numbers he’s probably most focused on are the deficit projections, and on this front, the Minister is projecting a strong fiscal outlook, with better-than-projected deficit figures and a return to a balanced budget by next year – well ahead of schedule.

These deficit projections are rooted in both relatively strong tax revenue growth over the past two years and relatively modest spending plans.

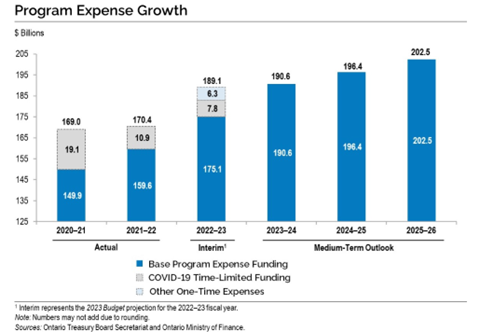

In fact, it’s this modesty of spending growth that will likely be where the opposition focuses attention. Even though there are increases in health sector spending (going from $74.9 billion in ‘22-’23 to $81.0 billion in ‘23-’24 and $84.2 billion in ‘24-’25) and education (going from $32.4 billion in ‘22-’23 to $36.1 billion in ‘24-’25), modest increases in Children, Community and Social Services, and continued significant investment in a range of infrastructure projects, these increases are not keeping pace with inflation or with the growth of Ontario’s population. Critics will say that too many sectors and too many people are still falling behind – but of course, that’s a criticism heard every year, of every government, regardless of political stripe.

Budget Highlights:

Investment Highlights and New Initiatives:

- A new “Ontario Made Manufacturing Investment Tax Credit,” which will provide a 10 per cent refundable Corporate Income Tax credit of up to $2 million a year. This income tax support is budgeted to cost the Ontario treasury $780 million over the next three years and is available to qualifying Canadian-controlled private corporations.

- Creating more “investment-ready” land by working with Ontario municipalities to identify mega-sites that can support large manufacturing investments.

- Advancing Ontario’s Critical Minerals Strategy, which supports better supply chain connections between industries, resources, and workers in Northern Ontario and manufacturing in Southern Ontario, including Ontario-based electric vehicle (EV) and battery manufacturing. The government is investing an additional $3 million in 2023–24 and $3 million in 2024–25 in the Ontario Junior Exploration Program to help more companies search for potential mineral deposits and attract further investments in this growing sector. The government is also continuing work with First Nations partners to build the roads to the Ring of Fire.

- Further efforts to leverage over $16 billion in investments by global automakers and suppliers of EV batteries and battery materials to position Ontario as a global leader on the EV supply chain. (This $16 billion number does not include the most recent announcement for a subsidiary of Volkswagen AG to establish an EV battery manufacturing facility in St. Thomas, Ontario.)

- Continuing commitment to the construction of key infrastructure projects, including the future Bradford Bypass, the next phase of construction for the new Highway 7 between Kitchener and Guelph, continuing work to widen Highway 401 from Pickering through Eastern Ontario, as well as moving ahead with plans to build Highway 413.

- Providing $224 million in 2023–24 for a new capital stream of the Skills Development Fund to leverage private-sector expertise and expand training centres, including union training halls to provide more accessible, flexible training opportunities for workers.

- Enhancing the Ontario Immigrant Nominee Program with an additional $25 million over three years to attract more skilled workers, including in-demand professionals in the skilled trades, to the province.

Affordability & Social Initiatives:

- Supporting care for first responders experiencing Post-Traumatic Stress Injury and other concurrent mental health disorders at Runnymede Healthcare Centre’s First Responders Wellness and Rehabilitation Centre, by advancing the dual-site project towards construction in Toronto and Peel, with an additional investment of $9.6 million.

- Providing financial support to more seniors by expanding the Guaranteed Annual Income System (GAINS) program. An additional 100,000 seniors will be eligible for the program and the benefit will be adjusted annually to inflation.

- Calling on the federal government to defer the Harmonized Sales Tax (HST) on all new large-scale purpose-built rental housing projects to tackle the ongoing housing affordability crisis.

- Investing in supportive housing with an additional $202 million each year in the Homelessness Prevention Program and Indigenous Supportive Housing Program to help those experiencing or at risk of homelessness.

- Helping more Ontario students become doctors by investing an additional $33 million over three years to add 100 undergraduate seats beginning in 2023, as well as 154 postgraduate medical training seats to prioritize Ontario residents trained at home and abroad beginning in 2024, and onwards. Ontario residents will also continue to be prioritized for undergraduate spots at medical schools in the province.

- Starting in fall 2023, expanding the program to allow pharmacists to prescribe over-the-counter medication for more common ailments, including mild to moderate acne, canker sores, diaper dermatitis, yeast infections, pinworms and threadworms, and nausea and vomiting in pregnancy.

- Providing an additional $425 million over three years to connect more people to mental health and addictions services, including a five per cent increase in the base funding of community-based mental health and addictions service providers funded by the Ministry of Health.

- Continuing the 2022 Budget commitment to invest $1 billion over three years for home care. The government is now accelerating investments to bring funding in 2023–24 up to $569 million, including nearly $300 million to support contract rate increases to stabilize the home and community care workforce. This funding will also expand home care services and improve its quality, making it easier and faster for people to connect to care.

- Improving long-term outcomes for youth leaving the child welfare system by investing $170 million over three years to support the Ready, Set, Go program to help youth achieve financial independence through life skills development, supports to pursue post-secondary education, training and pathways to employment.

Hospital Infrastructure:

In the 2022-23 budget, released just before the spring 2022 election, a key plank was a promise to spend $40 billion over 10 years, including $27 billion in capital grants, to support 50 hospital projects and add 3,000 new beds over 10 years. This year, the promise is $48 billion over ten years, including $32 billion in hospital capital grants, for the same number of projects and new beds – a reflection of the high rate of construction inflation that the sector has experienced. This will be something to watch in future budgets.

Budget Bill:

Every Ontario Budget is accompanied by an omnibus budget bill. That bill was tabled today, but won’t be available to review in detail until tomorrow morning. Technical changes to insurance regulations, tax measures and the Financial Services Regulatory Authority may be consequential for a number of stakeholders. Counsel will be pouring over that bill in the days to come and will flag particular items of interest to our clients.

Conclusions:

While the budget speech and document themselves don’t contain a lot of news and won’t make a lot of waves, they do not show a government that lacks ambition. In fact, the document and speech highlight a busy agenda with high levels of activity in economic development – especially in manufacturing and mining, aggressive health reforms with the goal of dealing with chronic shortages and setting the system up for sustainability, and a continued focus on infrastructure investment and getting housing built.

Instead of announcing new initiatives and policy and legislation, this budget is focused on implementation and execution. It’s aimed at fulfilling the promise Premier Ford made in the last election to “get it done.”

If you have questions about what this budget means for your sector, business, or association, please reach out to the Counsel Public Affairs team: