Today’s budget focused on five elements:

- “Rebuilding Ontario’s economy”

- “Working for workers”

- “Building highways and key infrastructure”

- “Keeping costs down”

- “A plan to stay open”

We’ve noted some of the major – and minor – initiatives that we think deserve to be highlighted. It’s not a comprehensive list, and more details will emerge in the coming days. For those who want to dive into the depths, the nearly 300-page budget document can be found here.

BUDGET LEGISLATION

Unlike most budgets, the Ford government has no interest in passing a “budget bill”, though one was introduced this afternoon. In fact, almost as soon as the Budget was released, the Ontario legislature “rose” until September. Writs of election are expected May 4th, with an Election Day to be set for June 2nd.

In press availabilities today, reporters asked Minister Bethlenfalvy repeatedly whether the same budget would be introduced if the government is re-elected. The Minister refused to confirm this, saying that he could not predict what might happen in the campaign.

Of course, this opened the government up to attack from the Opposition who claimed that the “real budget” was hidden away and wouldn’t be seen until after the election. Government spokespeople were forced to “clarify”, while the Minister was still delivering his speech, that this same budget would be re-introduced should Ford be re-elected.

The Minister’s obfuscation does suggest the plan is for more promises to be released during the campaign, beyond what was revealed today.

THE HEADLINES

Perhaps the single biggest headline coming from this Budget – other than the $160 billion in announced infrastructure spending – is the nearly $20 billion projected deficit for the coming fiscal year. Projecting such a large number is clearly a calculated risk by Bethlenfalvy and Ford. It’s one they can take because they believe none of their competitors have sufficient credibility on fiscal matters and that the PC’s “fiscal conservative” right flank will be assuaged as long as they win.

Ford and his government are okay running a deficit this size – and growing overall spending to nearly $200 billion a year, without any substantial tax cuts – as long as they can deliver new hospitals, highways, subways, LRTs and long-term care homes to ridings across Ontario.

WHAT IS MISSING

The word “climate” appears just five times in the larger budget document, with no references to cutting greenhouse gas emissions. The government is touting its investments in critical mineral mining as a strategy to grow the electric vehicle battery sector, and indirectly cut greenhouse gas emissions, but many were looking for more specific action on this file.

The Opposition are already pointing out that the “glaring omission” from this Budget document is any mention of autism and children’s mental health funding.

Several key sectors were not highlighted, including forestry and agriculture. But when viewed as a platform document rather than a regular budget, the calculus is evident. There are relatively few seats in the North, where forestry is a dominant industry, and the Tories already hold and expect to retain the majority of votes in rural Ontario.

OVERALL IMPRESSIONS

Today’s budget contained few surprises or “new” news – but today’s budget wasn’t meant to be the last chapter in the Ford re-election campaign playbook, but rather the first.

The agenda is set for the coming election campaign. Premier Ford is clearly interested in making the “ballot question” a focus on “building” – hard, physical building of lots of big projects, with plenty of opportunity for sod turning, ribbon cutting and announcements. But he’s also shoring up his political vulnerabilities with baubles like tax cuts for low and modest-income families, raising the minimum wage and clearing the surgical backlog.

Overall, this budget has a little bit of something for (nearly) everyone. That is both its strength and weakness. With most of the highest-profile inclusions having been revealed well in advance, there are few signature pieces that will spark water cooler discussions (or the digital COVID-era equivalents).

Now it is on to the campaign trail.

PROGRAM HIGHLIGHTS

Infrastructure Spending:

- Overall infrastructure plan of $158B over 10 years, up from $145.4B over 10 years allocated in 2021 Ontario Budget

- Highway expansion and rehabilitation funding

- $25.1B in funding over next 10 years, up from the more than $21B allocated over 10 years in last year’s budget (which included $2.6B in 2021-22 FY)

- Transit expansion

- $61.6B in funding over next 10 years – much of this previously allocated to major projects including the Ontario Line subway, however, does include funding commitments to advance a number of early-stage projects, including extending GO Rail service to Bowmanville, the Sheppard Subway extension and the Eglinton Crosstown West extension to Lester B. Pearson International Airport

Health Care:

- $40B over the next ten years to invest in hospital and health infrastructure

- Supporting 50 major hospital projects, adding 3,000 new beds over 10 years

- This is an increase of $10 billion from previously announced funding

- Additional $204M for mental health and addiction services

- Adding to 2020 Roadmap to Wellness investment of $3.8B over 10 years

- $230M in additional funds in 2022-23 to enhance health care capacity, including critical care

- $300M investment in 2022-23 for the Surgical Recovery Strategy, totaling $880 million from the start of the pandemic, to clear the backlog of surgeries resulting from COVID.

- Investments in Seniors and LTC

- 31,705 new LTC beds by 2028

- New Ontario Seniors Care at Home Tax Credit – $110M in support of 200,000 low to moderate income senior families

- $1B over next three years to expand home care

- $2.8B over the next three years to make PSW/DSW wage enhancement permanent (an increase from previously announced $893 million projected for 2022-23)

- $60M over two years starting in 2022-23 to continue expansion of Community Paramedicine for Long-Term Care program, allowing it to serve all seniors

“Working for Workers”:

- A “Community Jobs Initiative” which is meant to spread Ontario public service jobs throughout the province, starting with the move of the Workers Safety and Insurance Board (WSIB) headquarters from downtown Toronto to London, ON. Other agencies slated to move include Invest Ontario, Supply Chain Ontario and Intellectual Property Ontario

- A cut to the taxes paid by low and modest-income families through an expansion of the LIFT – Low-Income Individuals and Families Tax Credit by expanding eligibility from $38,000 to $50,000. Nearly 1.1 million individuals will benefit from this tax break, averaging $300.

- An additional $268.5M over three years to Employment Ontario to strengthen skills training and employment programs

- Maintaining the current tuition freeze for Ontario’s publicly assisted colleges and universities for academic year 22-23

- Raising minimum wage to $15.50/hr, starting October 1, 2022

- Additional $114.4M over three years in the Skilled Trades Strategy

- $15.1M over three years in the Ontario Immigrant Nominee Program

Other Items of Interest:

- Ontario is preparing to create the first operating provincial park with 4-season facilities in 40 years. No word on where or what it is, setting the stage for an obvious campaign announcement

- $42.5M over two years beginning in 23-24 to support the expansion of undergraduate and postgraduate medical education in Ontario

- Expanding college degree granting to help build a pipeline of job-ready graduates in applied fields and allow students to gain the education, experience and skills to enter the workforce faster

Economic Growth:

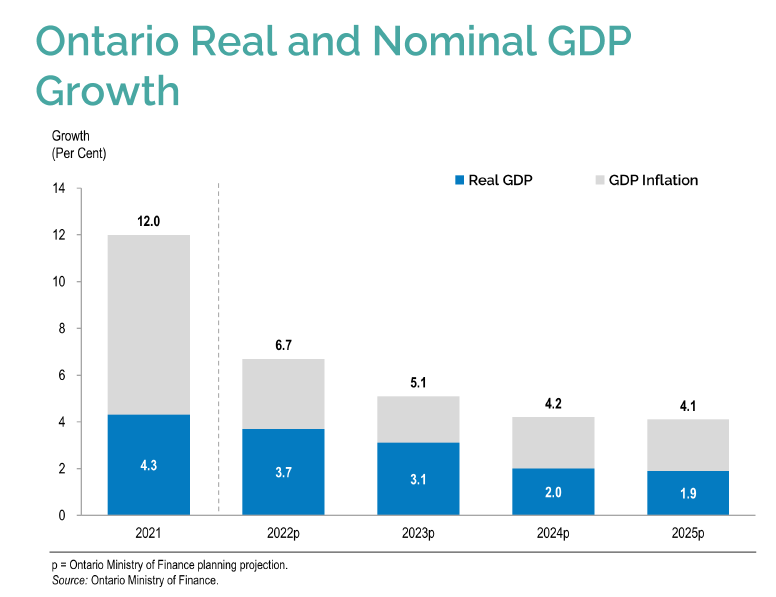

- Real GDP growth of 3.7% projected for 2022

- Nominal GDP growth of 6.7% for 2022 (down from 12% in 2021)

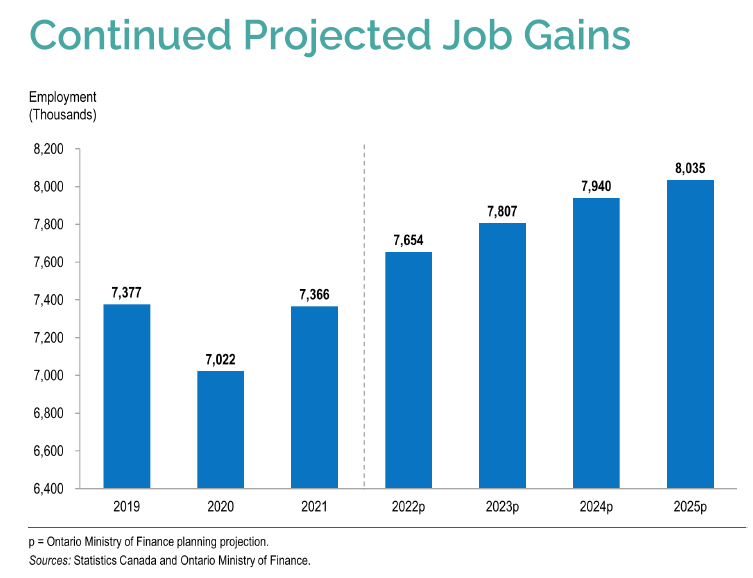

- Employment growth of 3.9% in 2022 – fully recovering all jobs lost from the pandemic and more

- CPI Inflation of 4.7% – which given international trends, may be a low-estimate

The 2021 Budget forecast a deficit of $33.1 billion in 2021-22, but that number has been significantly adjusted to just $13.5 billion. Going forward, however, the province is looking to use this added fiscal “room” to increase spending in a number of areas and is projecting a budget deficit of $19.9 billion for 2022-23, reducing somewhat to $12.3 billion in 2023-24.

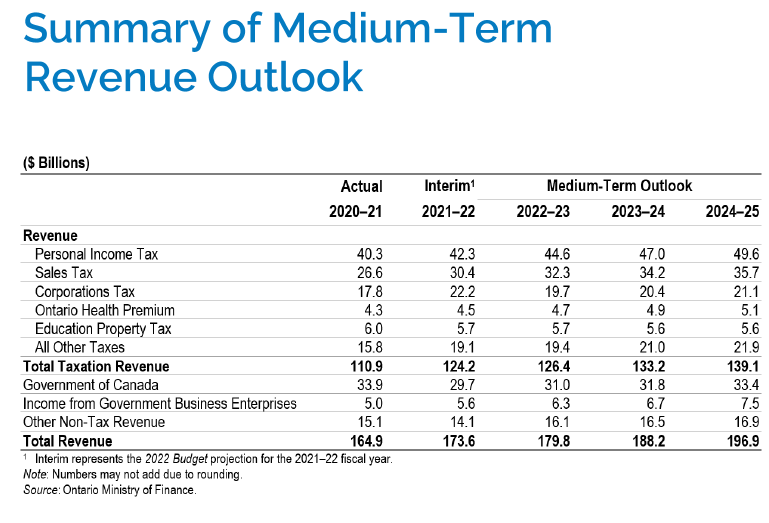

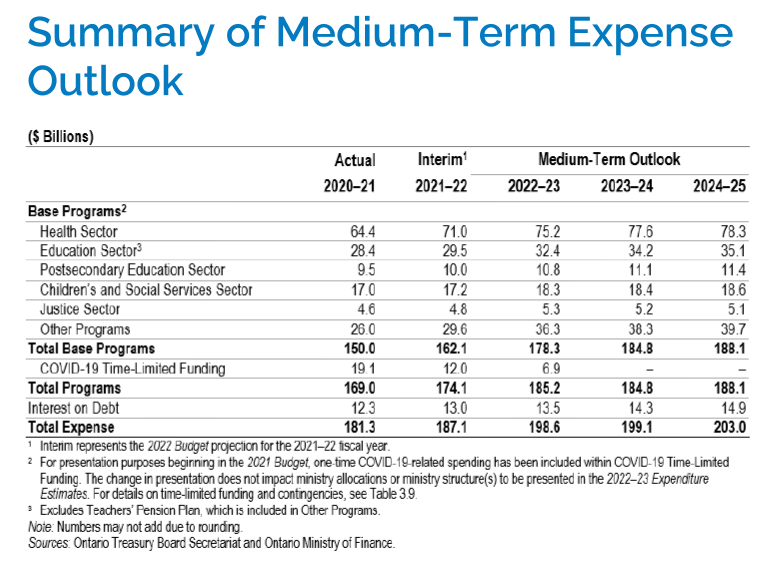

The heavy lifting for this deficit reduction is being done by the surge in revenues, especially sales tax and corporations tax revenue as this chart shows. This unexpected revenue growth gave the Minister of Finance the opening to come forward with a lot of new spending and investments, including a surge of $10.8 billion in health sector funding in just two years.

Counsel's multi-partisan team is here to support your Ontario Government Relations needs.

Philip Dewan

President and Founding Partner

Caroline Pinto

Founding Partner -

Ontario Practice Lead

Brad Lavigne

Partner -

Western Practice Lead

Bob Lopinski

Partner - Communications & Campaigns Lead

Michael Ras

Senior Vice President

Devan Sommerville

Associate Vice President

Logan Ross

Vice President,

Communications & Campaigns

Lorne Geller

Consultant, Ontario

Shawn Cruz

Research Associate